The cannabis industry is still missing a very critical component to further its progress towards legitimization: access to banking.

However, in Colorado, they expect Governor Hickenlooper to sign a bill. A bill that would push the banking conversation forward a step in the Centennial State.

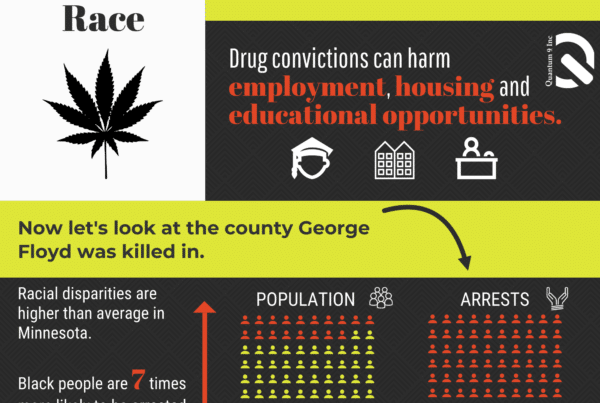

Despite the Obama administration setting out conditions for banks on how to interact with marijuana companies back in February. Most banks and credit unions continue to refuse to do business with companies involved in cannabis.

While many are excited about HB-1398 in Colorado, many believe that it won’t result in much action from the banks. Banks still have to worry about complying with federal money laundering laws (Makes you wonder how the Feds paid for all of that cannabis they ordered last week, doesn’t it?).

Even if the bill passes, the Federal Reserve still has to provide permission to the would-be cannabis co-ops. Industry experts don’t expect the Fed to be as dovish on cannabis as they are on monetary policy.

Even if banks, large or small, national or local, want to involve themselves and help the situation, I’m sure their legal teams have another opinion. In addition, because of the highly regulated environment, financial institutions are wary about lending money to organizations that may not be able to fully comply with the multitude of rules and regulations placed upon cultivators and dispensaries. With strict regulations and rules, banks don’t want to place a losing bet. Especially with an organization that can have its assets seized by the state.

This problem is only going to become more and more apparent as time goes on. In order to really fix the problem Congress, Federal Reserve, and Treasury need to act.