The state of Illinois released three more draft cannabis rules on Feb. 7, not without controversy. The Department of Revenue, Department of Agriculture and Department of Financial and Professional Regulation have drafted documents that come at a quite a high cost to business owners.

Cultivation centers will have to fork over $200,000 for a permit. This is upon approval of an application, for which business owners are required to include a $25,000 non-refundable application fee. Each annual renewal of a cultivation center permit will be $100,000.

If these fees sound high, consider the fact that a cultivation center must provide “evidence of fiscal responsibility,” by having either an escrow account or a bond in the amount of $2 million.

Other cultivation center fees include $100 per agent I.D. card, $1,000 for a name, ownership or non-cosmetic changes to a center, $5,000 for a cultivation center alteration application, and $3,000 if approved. Finally, a non-refundable fee of $100 will be required for each registered cannabis product.

In addition to the fees, cultivation centers will only have 30 days to submit applications once the application period begins. With 23 required line items, in addition to a notarized statement, it is evident that businesses must begin preparing documents long before the application period begins, which will be announced on the Department of Agriculture’s website.

The document also includes rules surrounding cultivation center requirements, including fingerprint-based background checks; operations, including production areas, security, and video surveillance; laboratory testing; and enforcement.

Similar fees and extensive application procedures are required for the 60 potential dispensaries dispersed across the state, including proof of liquid assets in the amount of $400,000. Application fees are $5,000 and permit fees $30,000. Annual license renewal is $25,000.

Dispensary operations are outlined in the draft, including security and recordkeeping, and discipline.

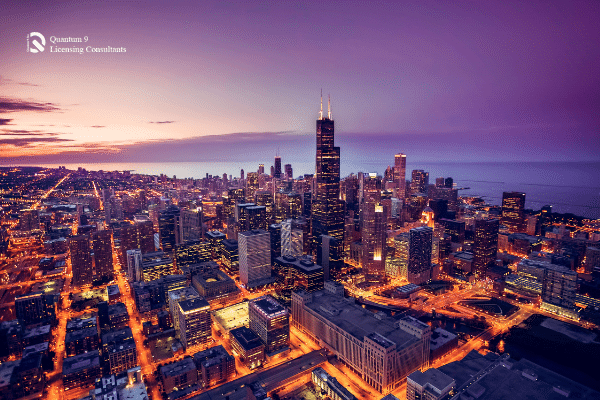

Also included is a divisional plan for 43 geographically dispersed districts. The area outside of the Chicago Metropolitan area will be awarded 21 licenses. The part of the state within the Chicago Metropolitan area but not in Cook County will be awarded 15. The part of Cook County outside of the City of Chicago will be given 11 registrations, while the City of Chicago will be given 13. Each of the dispensing organization Districts is specifically outlined in the draft.

Finally, the Department of Revenue released, among other things, a tax rate of 7% of the sales price per ounce for cultivation center sales and 1% for dispensary sales.

These drafts are in addition to the Department of Public Health’s documents released in January. All drafts are currently open for public comment.