Yes, you heard right, Illinois legalized cannabis!

Illinois became the 11th state to legalize adult-use cannabis, and the first state to create its adult-use industry through its legislators.

Governor J.B. Pritzker signed the 610-page bill into law legalizing the sale and possession of cannabis for adults aged 21 and older. In short, the state will tax and regulate cannabis in a similar fashion to alcohol.

The new law will also expunge low-level cannabis convictions and provide benefits for communities and business applicants disproportionately affected by cannabis prohibition.

Our cannabis consultants at Quantum 9 took the liberty of summarizing key points of the law for your convenience:

When will cannabis be legal and when can you start buying it?

On January 1st, 2020, the sale, possession, and consumption of cannabis will be legal in Illinois for adults 21+.

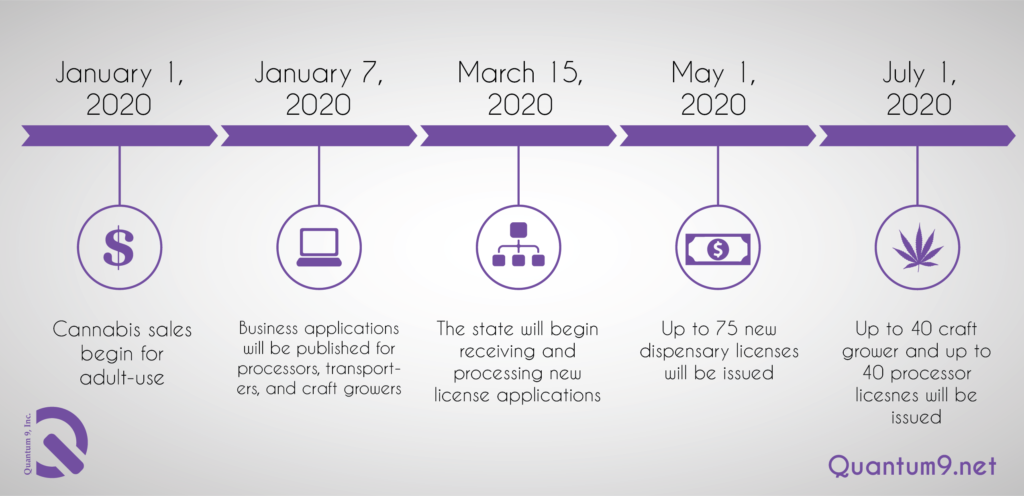

The schedule for transitioning into a legal cannabis market will follow this timeline:

How much cannabis can you possess in Illinois?

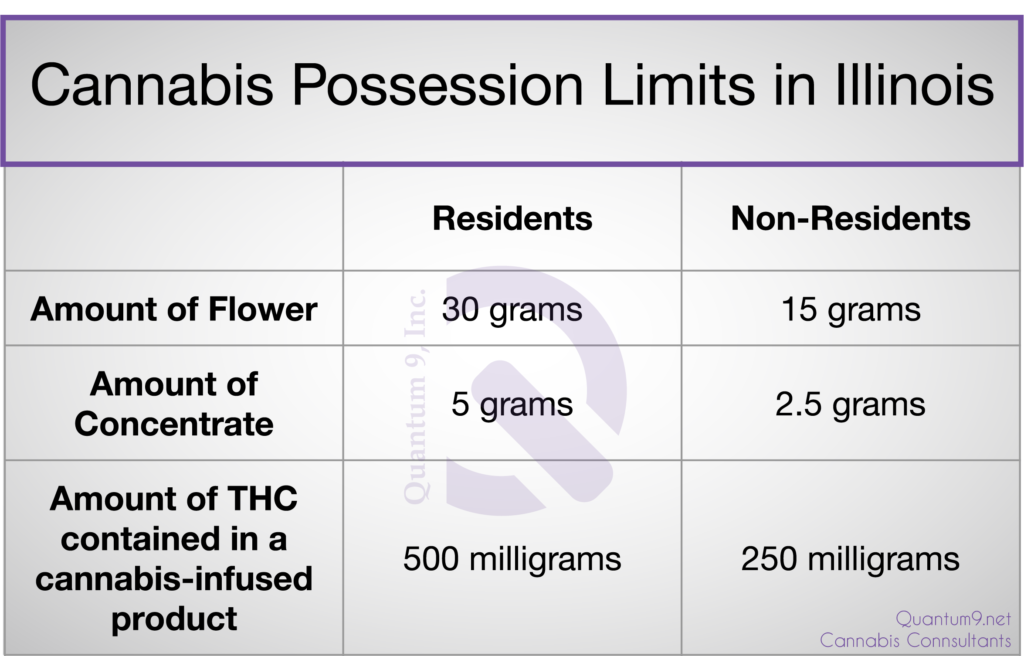

Illinois residents and non-residents age 21+ will be able to purchase cannabis from licensed sellers (no medical card will be required for the purchase of cannabis).

The table below summarizes the cannabis possession limits for Illinois residents and non-residents:

As shown in the table above, the possession limit is lower for non-residents of Illinois.

How will Illinois promote social equity?

The new law provides funding and assistance for business applicants and communities that have been affected by the prohibition on cannabis. Also, the state will set market caps and limits on ownership to prevent big businesses from dominating the Illinois cannabis market.

Pritzker explained in a statement that “This will have a transformational impact on our state, creating opportunity in the communities that need it most and giving so many a second chance.”

Expunging Criminal Records (up to 800,000)

In addition, the criminal justice reform outlined in the new law is by far the largest one in the cannabis industry. According to the Illinois State Police Advisory Council, the state will expunge around 800,000 cannabis-related cases.

For convictions of cannabis possession of 30 grams or less, the criminal records will be automatically expunged.

For convictions of cannabis possession of 30-500 grams, the individual or their state attorney can petition the court to expunge the conviction.

Where can you smoke cannabis in Illinois?

The law will allow people to consume cannabis in their own homes and in businesses that permit consumption on the premises.

In contrast, the bill prevents you from consuming cannabis in the following areas:

- Public property (parks, streets, etc.)

- While operating any motorized vehicle

- On or near school grounds (except for medical users)

- Near anyone who is under the age of 21

Who is able to ban cannabis consumption in Illinois?

Although Illinois has legalized cannabis, any business or landlord can prohibit the use of cannabis on private property. Also, colleges and universities are allowed to ban the use of cannabis.

In addition, counties and municipalities have the ability to ban cannabis businesses. But they may not ban individual possession or consumption of cannabis.

Who can grow cannabis in Illinois?

The law states that only licensed cultivation centers, craft growers, and medical cannabis patients will be allowed to grow cannabis plants.

On the other hand, non-medical cannabis users will not be able to grow plants at home.

Initially, only the 20 existing cannabis cultivation centers will be growing cannabis in early 2020. Then in July 2020, up to 40 craft grower licenses will be awarded. The state will have a preference for licensing social equity applicants.

Medical cannabis patients will be able to grow up to 5 cannabis plants per household. However, the patients must keep the homegrown plants in a locked room away from the public view.

How will cannabis be taxed?

Illinois will base the tax rate on the type and potency of the cannabis product. In general, the tax rate is higher for products containing a higher concentration of THC.

Cannabis tax rates will fall into the following categories:

- 10% tax on purchases of cannabis flower or products with less than 35% THC.

- 20% tax on purchases of cannabis-infused products, such as edibles.

- 35% tax on purchases of any cannabis product with more than 35% THC.

In addition to the cannabis tax rates mentioned above, the standard state (6.25%) and local (up to 3.5%) sales taxes will also apply.

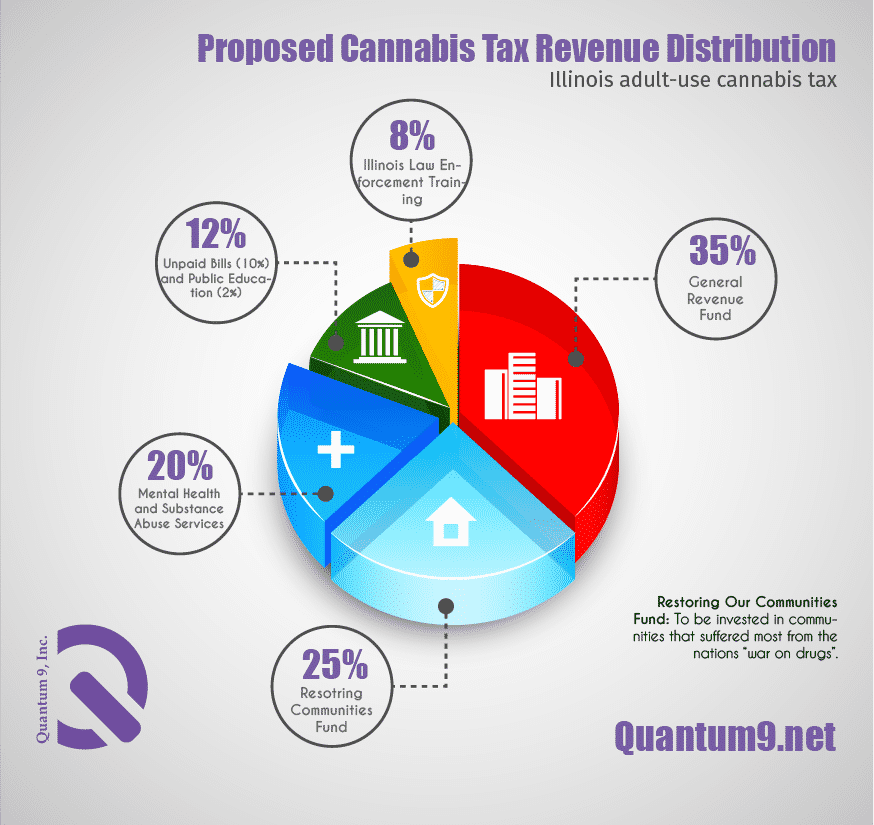

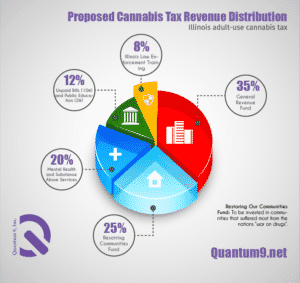

How will cannabis tax revenue be allocated?

The cannabis tax revenue will first be used to pay the costs of administration and expungement fees.

Afterwards, the plan is to distribute the remaining funds in the following manner:

Concluding Remarks

Since Illinois legalized cannabis, the adult-use market will offer ample opportunities for consumers, entrepreneurs, and investors.

Please feel free to reach out to one of our cannabis consultants at Quantum 9. With our HQ stationed in Chicago, we are ecstatic to aid your entry into the Illinois adult-use market.

To find out if you or an applicant are eligible to participate in the Illinois Adult-Use Social Equity Program, click on this map.